|

THE NATIONAL DEBT

|

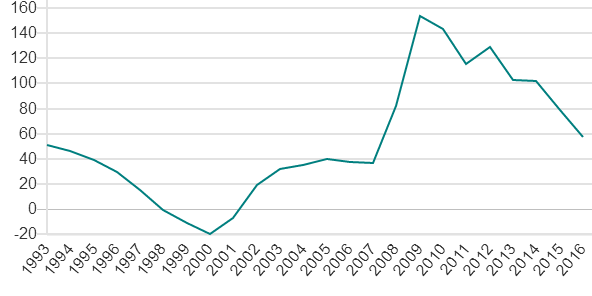

Take a look at the staggering national debts of £2.4 Trillion pounds, energy, food and cost of living crises. Should we perhaps consider a Moratorium. Not just the UK, the USA also seems to be up shit creek without a paddle - in fact, further along that mythical stinking watercourse at $31.4 Trillion dollars.

Quarter

Debt £billions as % GDP

UK general government gross debt was £2,365.4 billion at the end of Quarter 1 (Jan to Mar) 2022, equivalent to 99.6% of gross domestic product (GDP). Leaving almost no reserves, taking the country to the brink in any language. Where growth is contrary to sustainable or circular economics. Simply because earth is being drained at the rate of 2.4 planets, of the ability of the world to produce. Meaning that, to start to get things under control, borrowing needs to reduce to £985 billion pounds at present GDP.

In 2022, Rishi Sunak and Jeremy Hunt are on the economy warpath, targetting anything that moves, to raise money for our bankrupt nation. That means robbing pensioners, even where their savings are already worth around half of what they were before Liz Truss really mucked up with Kwasi Kwateng, apparently batting for the rest of the world.

What of food, you may have noticed shortages in your supermarkets. The good news is humans are edible. Just ask Hannibal Lecter. Even better, history shows us that fat politicians get eaten first. All the money in the world is no good to you when the food runs out. Then, you need a bow and arrow, or sharp knives.

The British Economy is a joke based on a joke from the year before. We are trying to keep things that we do not need for the sake of tradition such as outdated concepts like Queen Elizabeth Aircraft Carrier, Trident missiles and more Astute class Nuclear Submarines. Have they not heard of robotics, drones and satellites?

And what about importing energy that we cannot afford. Have they not heard about solar & wind farms and electric vehicles?

VOID CONTRACTS

But that is a contract that the electorate would never have agreed to. That is not what the people voted for. Election campaigns were mostly fraudulent. The Conservatives knew that, and still got themselves installed, mainly to milk the system, obtain consultancy payments, get paid large sums for making speeches - then make a quick getaway and pass the buck onto the next Parliament.

We think that Members of Parliament should be banned from accepting money for speech making, even post position. Likewise, Consultancy payments. Overseas transactions and declarations should be constantly monitored to check for fraud and inconsistencies with conflicts of interest.

Prime Minister

Theresa May

claims: that the Conservatives had, over the past seven years, cut the nation's deficit as a share of GDP by almost three-quarters.

Mr Hammond has not set a hard deadline for when that will be reduced to zero. Instead, in their 2017 manifesto, the Conservatives pledged to eliminate the deficit by the "middle of the next decade".

DEBT STATISTICS JUNE 2012

According to the Office for National Statistics (which is the executive office of the UK Statistics Authority, which reports directly to Parliament), the United Kingdom had a gross debt of:

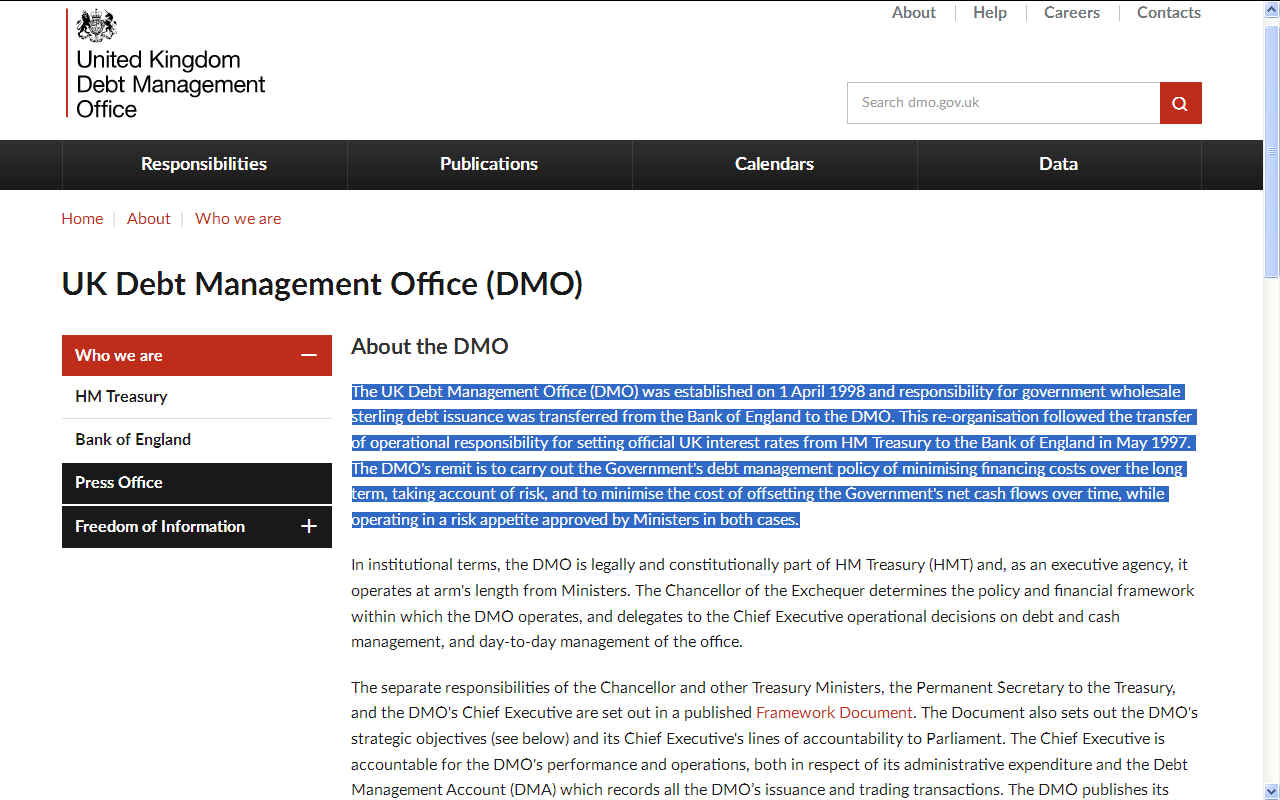

THE DMO

Our debt situation is so bad that we have to have a Debt Management Office.

The UK Debt Management Office (DMO) was established on 1 April 1998 and responsibility for government wholesale sterling debt issuance was transferred from the Bank of England to the DMO. This re-organisation followed the transfer of operational responsibility for setting official UK interest rates from HM Treasury to the Bank of England in May 1997. The DMO's remit is to carry out the Government's debt management policy of minimising financing costs over the long term, taking account of risk, and to minimise the cost of offsetting the Government's net cash flows over time, while operating in a risk appetite approved by Ministers in both cases.

WE'RE ON THE ROAD TO NOWHERE - One of the key elements to building a strong economy is decent roads. Roads are the arteries of commerce. They should be fit for service and efficient in terms of climate change.

NATIONAL DEBT LINKS

https://www.davemanuel.com/uk-national-debt-clock.php http://www.dmo.gov.uk/ http://www.bbc.co.uk/news/business-39897498

|

|

AFFORDABLE | CLIMATE | DEVELOPERS | ECONOMY | FLOOD | HISTORY | HOMES LADDER | MORALS | POVERTY | PROPERTY | SLAVERY | TAXES | SLUMS | VALUATIONS | WEALTH

|