|

SLAVE TRADERS - HIGHER COUNCIL TAXES

|

|||

BRITAIN

IS THE MOST CORRUPT COUNTRY IN THE WORLD - Drug money is funding

the building boom, as the UK allows overseas investors to purchase new builds, built such that locals cannot afford to buy

a home. You may have heard about the lack of affordable housing.

ARE COUNCIL'S SLAVE TRADERS?

If you think about it, the cost of housing is controlled by councils, via:

1. Local plans 2. Planning consents & refusals 3. Compulsory purchase 4. Purchase for supply

Councils control the supply of building land, with Local Plans and the granting or refusal of planning permission, that previously was at Committee by Councillors, but now can be left to the top heavy numbers of civil servants - where a member wants to duck out (delegated authority). And they love it. They are typically power hungry kleptocratic empire builders, demonstrable, in that there is (as we write) no genuinely affordable housing in the Wealden District.

And, wait for it. Developers are being let off having to build even a percentage of affordable housing. Despite Parkhurst Road Ltd v Secretary of State for Communities And Local Government & Anor [2018] EWHC 991 (Admin), setting the benchmark, that applies to all councils. The Duty to provide low cost housing.

As they say, power corrupts, and absolute power corrupts absolutely.

Councils have compulsory purchase powers, and can put charges on land, effectively making them the land owners. They can also purchase land, to provide a supply of low cost housing, in the free market. And, they routinely do so as investments in industrial sites. But not to supply affordable land for self builds and flat packs.

It stands to reason, that if there is a housing shortage, it is an affordable housing shortage. The cost of living crisis is partly because of the high rateable values of the housing there are consents for. Consents which have been granted to increase CIL payments and rake in more Band D and E council taxes.

Which, if there was a sufficient supply of low cost homes, such as for timber flatpacks and self-build plots, would break that cycle, and reduce the cost of living to low income families.

All council's need to do is stop giving consents for executive housing (rabbit hutch cardboard boxes) that low income families cannot afford, arguing at appeal (if necessary) that their first duty is to the electorate. That the developer is also bound to provide a supply of economical housing, but has not provided that quota. Because, they are only interested in profits.

Couple that with Local Plans that identify land as for affordable housing, and/or compulsory purchase. And councils would have a way of providing homes to combat the cost of living crisis - and, climate change. Because timber flatpacks are sustainable and lock up carbon. And low cost housing has a smaller carbon footprint.

So where are the identified areas in the Local Plan for affordable homes? Nowhere! They are criminally negligent in this regard. Criminal, because it is their duty to provide low cost housing, rather than seek to profit from their position of trust in society.

The fact is Wealden District Council does not have a properly formulated and acceptable Local Plan. One of their plans was rejected by the Planning Inspectorate. There is no provision for affordable land in their Draft (or emerging) Local Plans.

The plain fact is, that council's don't want low cost housing in their administrative area, for that would lower their income as kleptocrats, if more units were rated in Band A, instead of Bands D and E. If there income was reduced, they would not be able to underwrite the mounting pension bill, due to overstaffing, or inefficient workplace practices. Or, expenditure that should not have been authorised. Such as the purchase of land for purposes other than to cover their obligation to provide land for affordable housing. Being investments, other than to provide the services they are duty bound to provide.

It was former Prime Minister (Tory slave trader) Margaret Thatcher, who cancelled council house building, selling off low cost housing stocks. So opening up the market to such abuses. She also tried to introduce the Poll Tax, a policy that continues by the back door, where councils harass citizens who do not have a fixed address, trying to pin them down to an address, even though they may not be able to live there.

And, there are far too many chiefs, and not enough Indians. There are too many civil servants. Local and national government is top heavy with civil servants, rendering the economy inequitable. Where, it is the pensions that will sink the nation. In the case of councils, many pensions are enhanced, with NDAs (Non Disclosure Agreements) to prevent them from telling of the corruption. Known as Golden Handshakes.

Councils appear not to mind financially enslaving millions of people, exactly the same as slave traders enslaved Africans before abolition of that dreadful trade. Britain, has swapped trading the lives of Africans, for trading the lives of local residents. Who do not understand enough to revolt, and will not find support in the politicians of the day. For that would be swimming against the tide of a super heated economy which has all the hallmarks of a Ponzi scam. And the Magistrates Courts are in on it. Routinely dishing out (illegal) Liability Orders, to the financial slaves they helped to create. By being part of a corrupt system. The Magistrates courts being bought and paid for by the council, to rubber stamp Orders, without giving their victims their right to a fair hearing. [R v Sussex Justices ex parte McCarthy 1924] This is the very definition of a Kangaroo Court. The decision has already been made, they just need to go through the motions, and pretend to be a court. This ruse to frighten and threaten citizens, into submission. Thus, violating Article 3 (mental torture) as well as Article 6: the right to a fair trial, in addition to Article 17. This use of the Court buildings in Bohemia Road, Hastings, being for the express purposes of undermining the civil rights of any respondent.

The Summons is not even signed by a person, and no person has looked at any correspondence sent to the so-called Court. Because, there is no case officer and no case file.

In a fair hearing, a person must be given time to prepare their case. They cannot do so if the Claimant refused/refuses to comply with Data Subject Requests, and refuses point blank to provide information requested, such as to be able to prepare a properly thought out argument. Otherwise, the accused is being asked to operate blind, unable to mount any kind of reasonably informed defence.

As there is a criminal element relating to Council Tax, it is not just a hearing, it is more of a trial.

This is the case where councils do not want their accounts looked at, the present Conservative government allows that, because they are themselves corrupt, and transparency shy. And that is because of the National Debt, being more than our capacity to earn money (GDP), the debt set to increase in coming years. Taking the UK to debts of twice the (ever reducing) earning potential of the country.

Why? Because, we suspect, their accounts will show monies being spent irresponsibly, will reveal procurement fraud and the like, such as substantial consultancy fees paid to past employees. And, a lack of investment in land for affordable housing, etc. And the less said about potholes, the better. This is 'Pothole' politics, plain and simple.

Any and all of which could undermine the validity of a Council Tax Demand, as being culpable overcharging, a breach of trust, and a breach of contract. In one of the cases cited on this page, a request for this information had been properly made, but the information not supplied by Wealden. Then the Clerk to the Court tried to suggest that he could help overcome the respondent's request. Which of course was an Article 6 violation of that person's right to have sufficient time to prepare a case. Another example, to show that this so-called Court, was simply a rubber stamping mechanism. And since when is a Clerk to the Court, an adviser to the public in the dock? He, or she is an adviser to the Magistrates. And, they may not steer proceedings, other than to advise the Magistrates as to the Respondent's rights. Those rights clearly set out in the Human Rights and Fraud Act. But because there is not recording of the proceedings, they can get away with blue murder. Including, the Clerk to the Court's failure to advise.

We might consider eliminating civil servants, and courts like this, and using ChatGPT, with an algorithm that forces the system to recognize the right to a fair hearing. Referring such instances to a real Magistrates or Crown Court, with a right of appeal to a Crown Court, where there are transcripts from recordings, and where the players are not purchased to order by the offending council. And where there is are no Masonic influences. Where secret societies are banned. Such as in Italy and Poland.

It is unclear if the Magistrates swore an oath on the Bible before entering the courtroom. If they did, and considering the behavior of the chairperson, that might be considered blasphemy. No evidence was provided on oath by Mr Mike Wakefield. He was not required to stand in a dock to be questioned or take an oath, and that Article 6 right was not provided by the Court. Three other officers of the council were present. They claimed to be observers. Observers, at the expense of the public purse. Another matter for review, as to operational overheads and council taxes. The taxpayer had paid their salaries, just to attend court on this occasion. How often is that happening.

ARTICLE 6 HUMAN RIGHTS ACT 1998 & EUROPEAN CONVENTION ECHR

RIGHT

TO A FAIR TRIAL

(b) to have adequate time and facilities for the preparation of his defence;

(c) to defend himself in person or through legal assistance of his own choosing or, if he has not sufficient means to pay for legal assistance, to be given it free when the interests of justice so require;

(d) to examine or have examined witnesses against him and to obtain the attendance and examination of witnesses on his behalf under the same conditions as witnesses against him;

(e) to have the free assistance of an interpreter if he cannot understand or speak the language used in court.

It is apparent that the rights of the two Human Rights victims referred to, were violated. They were not provided with the information they had legitimately requested, such as to be able to prepare a defence. They were not provided with Legal Assistance, and they were denied the opportunity of presenting a case, including examining witnesses in the relevant Accounting and Planning departments as to the lack of expenditure on Affordable Housing.

In addition, where the lead Magistrate openly admitted that she would rely on the evidence of the Council's taxes officer, she introduced an Article 14 violation, openly discriminating against the rights of the Respondents.

In such circumstances, how can the bench be said to be impartial? How can any decisions that are made be challenged, if the court is effectively in secret session, and a closed shop. With no record of the proceedings. It is open to manipulation by an aberrant council and irksome justices. With the (in this case Kangaroo) court becoming party to the offences of Fraud, by way of a virtual conspiracy.

They have tied the hands of their victims, to prevent being challenged as to the rights and wrongs of the proceedings in the 'Mock' Magistrates Court. A situation that violates Article 17.

HUMAN RIGHTS VIOLATIONS - What is a Kangaroo Court? If you want to see a real Kangaroo court in action, head on down to Hastings where you might be lucky to catch the comedy act that is the making of a Liability Order. Firstly, it is not a real court, according to the Magistrates Courts Acts. And they certainly don't behave like a real court. A court that complies with the tenets of the Human Rights Act 1998. Indeed, from the evidence it looks to be that they have done everything they can to deprive their victims of their right to a fair hearing. So, violating Article 6. No wonder the likes of Dominic Raab, wanted to change it.

The Human Rights Act was introduced more than 20 years ago and it sets out in law a set of minimum standards of how everyone should be treated by public bodies.

It is very rare for a just and fair trial to occur in a kangaroo court. In most instances the verdict is already decided before the trial even begins.

In a kangaroo court, the principles of law and justice are not regarded leaving people to suffer unjustly as a result of that. These courts are normally referred to as mock courts because of their unorthodox ways.

- Judgment or punishment given by a kangaroo court is normally unfair – judgment or punishment can be too soft or too harsh

- Kangaroo courts usually use irresponsible and irregular methods in carrying out proceedings

- Real justice is not normally served in a kangaroo court

Two recent cases, allegedly, highlighted the working relationship between Magistrate, Mrs Alison Carragher, and council officer Mike (Michael) Wakeford [the accused]. Where the magistrate is quoted as saying, "anything Mr Wakeford says, is fine by me." Or words to that effect. This is of course demonstrable discrimination, a violation of Article 14. The Clerk to the Court, Jamie McCarthy, was also hired for the day, in the employ of the council. He claimed to be a qualified barrister. Yet, there is no court record, no transcript and no case file. The council, in this case Wealden, refused to provide evidence of where the taxes they were charging/billing for, are spent.

CONTRACT LAW

The essential elements for a Service Contract to be legally binding are:

That the "Services" provide have to be clearly identified, along with the cost of providing them.

The cost of such services should be offered to the client, for their consideration, and approval.

If the client agrees with the terms offered, they might agree to pay for them. If the terms of the provision of such services are unclear, before any agreement is entered into (acceptance), the service provider will have to justify their costs in relation to providing such services. Until such terms are clearly set out, and are deemed fair and reasonable by both parties, there is no liability to pay.

Equally, where it is known that a council has not provided an effective service, the client is under no obligation to agree to pay for those services, until any defect in such provision is rectified.

Obviously, where a council agrees to provide an effective service in relation to property, which for some reason includes roadways (that are taxed via a Road Fund License), rubbish disposal and the administration of planning services. Then, and only then, might any contact be valid.

It is important to know the difference between a legally binding and a void contract. A contract is void in certain circumstances. For example, a contract is void if the parties were mistaken as to the subject matter of the contract. A void contract means the agreement has no legal content. In other words, the parties cannot rely on the contract in a court case.

Healthcare, including social care, is already the subject of a different tax, via National Insurance payments.

WHAT MAKES A VOID-ABLE CONTRACT ?

A contract might be

void-able in certain circumstances, such as if the contract was entered into (even non consensually):

-

if the contract is voidable by a statute, for example, the Fraud Act

2006, or Human Rights Act 1998.

MONOPOLY

Citizens should have the right to choose the provider of the services that are (as these examples suggest) at present performed poorly by councils, so costing other taxpayers more money in the long term. The argument for private contractors to take over many of the services in relation to Property Taxes has never been stronger.

And, there should be an opt-out clause, where a property owner or occupier elects to provide their own property services. For example, disposing of their own rubbish, providing their own security and street lighting, and their own street cleaning. [Though lighting and drainage of roads may fall under the Road Fund License, and water and sewage rates are charged separately, and is already an option if you have a well and private treatment system.]

The State has privatised telephones, railways, water and sewage, energy companies, and many prisons. So, why not make the pool of money to provide the services that a council is supposed to provide, open to competitive bids, where any monopoly is bad for the consumer. The first and most obvious cut a private bidder can tender against, is slashing the red ink, by employing less staff. Other methods of reducing overheads, include telling the truth, admitting errors earlier on is far cheaper that entering into protracted litigation.

This is a sustainability issue, where the whole world is required to work towards a Circular Economy.

REPRESENTATION OF THE CITIZEN

In many cases Councillors will not represent some of the electorate, depriving them of that service, and so violating any deemed service contract. If a councillor does not respond to correspondence directly, they should be disenfranchised. Since, there services are funded from Council Taxes. At present, many members will not engage with citizens, where a council has at any point broken the law. This is another privatization issue.

CONTRACT NOT ACCEPTED, TERMS CHALLENGED

The Council, (in this case Wealden) knew that information of council expenditure requested, and that this was in connection with their Council Tax Bills. The Council were therefore required to give details of their accounts/expenditure/services/income/staffing costs and pensions relating to the Charges they were billing for. To enable the respondents to be able to have any chance of working out, presumably with the help of a forensic accountant, if the Bills were justified. This would entail the Council giving sufficient detail for a/the Respondent's to be able to be in a positing to calculate if they were being overcharged.

But, in this/these cases the Council appears to have gone out of their way to disguise expenditure, to prevent the Respondent(s) from having any chance at all of seeing what the financial position was and is.

Thus, the attempt by barrister, Jamie McCarthy, to assist the the Respondent, can only have been to try to baffle the Respondent even more, to get the Respondent to agree that the information provided by the Council was sufficient. When clearly, it was anything but. Then, there was an attempt by the Magistrate Alison Carragher, to get one of the Respondents to talk with the Council's Mr Wakeford, where his suggestions had included Debt Relief Orders. An admission that the Council's taxes had created a situation where there was no way out, other than to seek to declare insolvency. An admission, that living in the Wealden area was inequitable. That situation, being the creation of the Council, in not providing a rolling stock of land for affordable housing.

Councils are required to process planning applications in accordance with the European Convention, as per the European Communities Act of 1972. This is one of the services councils contract with the tax payer to provide. Being required to, contracting to determine such planning applications in accordance with Article 3, 6, 8, 13, 14 and 17. Which in the case of one of the victims cited on this page, was not the case. Discrimination being the trigger, in relation to a grant that this Council decided to deprive the applicant of, so violating his right to a fair hearing. The Services Contract being breached, until such times as Wealden put the matter right, by way of an effective remedy.

Effective in this case, also carrying with it the burden of providing Just Satisfaction, for having violated the citizens rights, multiplied by, and for as many years as it takes to secure fair treatment. [Davis v Wansdyke District Council (Nov 2001) - Out of Court settlement of £790,000. Where Bristol County Court ruled that planning officers had conducted themselves in a consistently unhelpful and obstructive fashion – unfavourable treatment.]

HOW MANY OTHER RATEPAYERS ARE IN ARREARS?

In order to gain a picture as to whether council taxes are reasonable, we need to know how many people in the Wealden District are in arrears. This information was not provided by the Council. But, was reasonably necessary to be able to frame a proper argument. For if low income families are routinely in debt, then the Council are not providing an Effective Administration, and (for example) council taxes would need to be reduced. Probably, by reducing staffing levels, and sourcing cheaper suppliers.

For sure, a solid Local Plan would help housing developers know what is required of them. And, self-builders, flat pack installers, and the like, could also see where opportunities exist for low cost housing.

The Council do not want anyone to have a clear picture of their financials, because, they are operating negligently, or worse, could be heading toward insolvency. Though, they claim not.

LACK OF PROPORTIONALITY

Council taxes are unfair, in that people without children, are asked to contribute to the education system and schools and libraries. Hence, they are being asked to pay to educate children not belonging to them, without any choice in the matter. And, those who don't use libraries to read books, are being asked to pay for those who read books.

Parents who home school, should not be charged for schools or education.

It is a simple matter to determine if someone uses a library, or if they do or do not have no children. In any event, libraries are a thing of the past. Today, almost everyone uses the internet for research, or they buy books from Amazon or Kindle. In many cases buying online is cheaper than taking a trip into town to use a library. For sure, the internet is cheaper.

The absolute lack of proportionality, inversely financially discriminates against those who cannot benefit from the services being charged for, as part of the 'Service Contract.'

One of the perceived problems in the Wealden district, is monies given to Sussex police, are often used to cover up reported

crimes, an unlawful/illegal alliance, and misuse of public monies. Hence, victims are being charged

Council Taxes to fund SLAPP actions and malicious prosecutions. And that misuse of public monies breaks any contract with the victims.

1. Parish 2. District 3. County

Then there are MPs on top, with whole armies of civil servants working from home. Why are so many councillors needed? Why the duplication of effort? Especially, when they fail to respond to communications. You are paying for them to ignore you, and not take on board any of your representations. There is almost total unaccountability.

Councillors are remunerated from Council Taxes. If the administration is top heavy, taxes will be disproportionately high, for the job in hand. Not only that, but the abject failure of all these chiefs, to provide affordable accommodation within East Sussex, reveals that the mob handed approach is not working.

If you do not get a reply from your local, district of county councillors, any contract between yourself and the council seeking to bill you for services, is more than likely broken. The more serious the failure(s) on the part of those in the chain, the more broken any deemed contract.

For example, you will not get any reply, if a council is guilty of maladministration = broken contract.

You will not get any reply if misfeasance in public office is involved = broken contract.

You will not get any reply if there is malfeasance in public office, and you may find documents are being shredded routinely to cover up their wrongdoing. Which is of course a criminal offence = broken contract.

You will not get proper legally compliant replies to FOIs or DSARs in the event of any of the above = broken contract.

If any of this applies to you. Keep all the documents for a Claim in Europe. The guilty council will deny such documents exist. And there is no Effective Remedy in the UK. Not unless the Information Commissioner agrees to investigate and then prosecutes. And even then, there is no compensation payable (just satisfaction).

FIRE BRIGADE

Just about the only service worth contributing toward, is the Fire Service. A kind of property insurance policy. The Fire Service is only called on when there is an emergency. It is unlikely to suffer serious ongoing procurement fraud, other than contracts to supply Fire Engines, and other fire fighting equipment, that presumably go out to tender. But, once the equipment is paid for, the only costs are paying for the fire fighters.

Firemen, will not be languishing at home, and charging while the surf the net, watch television, or worse, languishing on vacation, while pretending to be working from home.

ARTICLE 14 ECHR & HUMAN RIGHTS ACT 1998

PROHIBITION

OF DISCRIMINATION

[Clearly though, the policies of this Council, favour wealthy landowners, over low income families. Promoting a two tier society that is unsustainable in climate terms. Where property ownership, hence lower housing costs, are denied to poorer members of society. Those affordable houses being sustainable. People without children are being unfairly discriminated against, being charged for a service, they cannot possibly take advantage of.]

ARTICLE

17 ECHR & HUMAN RIGHTS ACT 1998 PROHIBITION OF ABUSE OF RIGHTS

[The Council have rigged a mock-court situation, expressly for the purpose of rubber stamping Liability Orders, denying respondents a right to a fair hearing; and a right of appeal. This is to bully members of the public into making payments to underpin an administration that is ineffective. The Council have failed to provide a rolling stock of land for affordable housing, in exceptional cases, or at all. Though, with the cost of living crisis, there are more families in need, and this should have been anticipated and planned for in their Local Plan. Their Local Plans are deficient.]

CONTRACTUAL OBLIGATIONS - DEEMED OR OTHERWISE

There is of course a deemed contract between ratepayer and service provider. Any contract might be voided, if there is fraud, or other unlawful use of the monies collected to provide services. Such as overly high staffing costs, bonuses and pension packages, investments in oil companies for those enhanced pensions, and nothing on providing affordable land for self-builds, electric vehicle charging points, etc. In other words, they are in breach of the deemed contract to provide reasonably priced housing in a climate crisis, and reasonable charges for those services, aimed at electrification and renewable energy, as a requirement of the Climate Change Act 2008.

This Council purchased thousands of parking meters, that were unusable, at considerable expense to the taxpayer.

Fraud unravels all: Sharland V Sharland 2015 UKSC 60 (On appeal from: [2014] EWCA Civ 95)

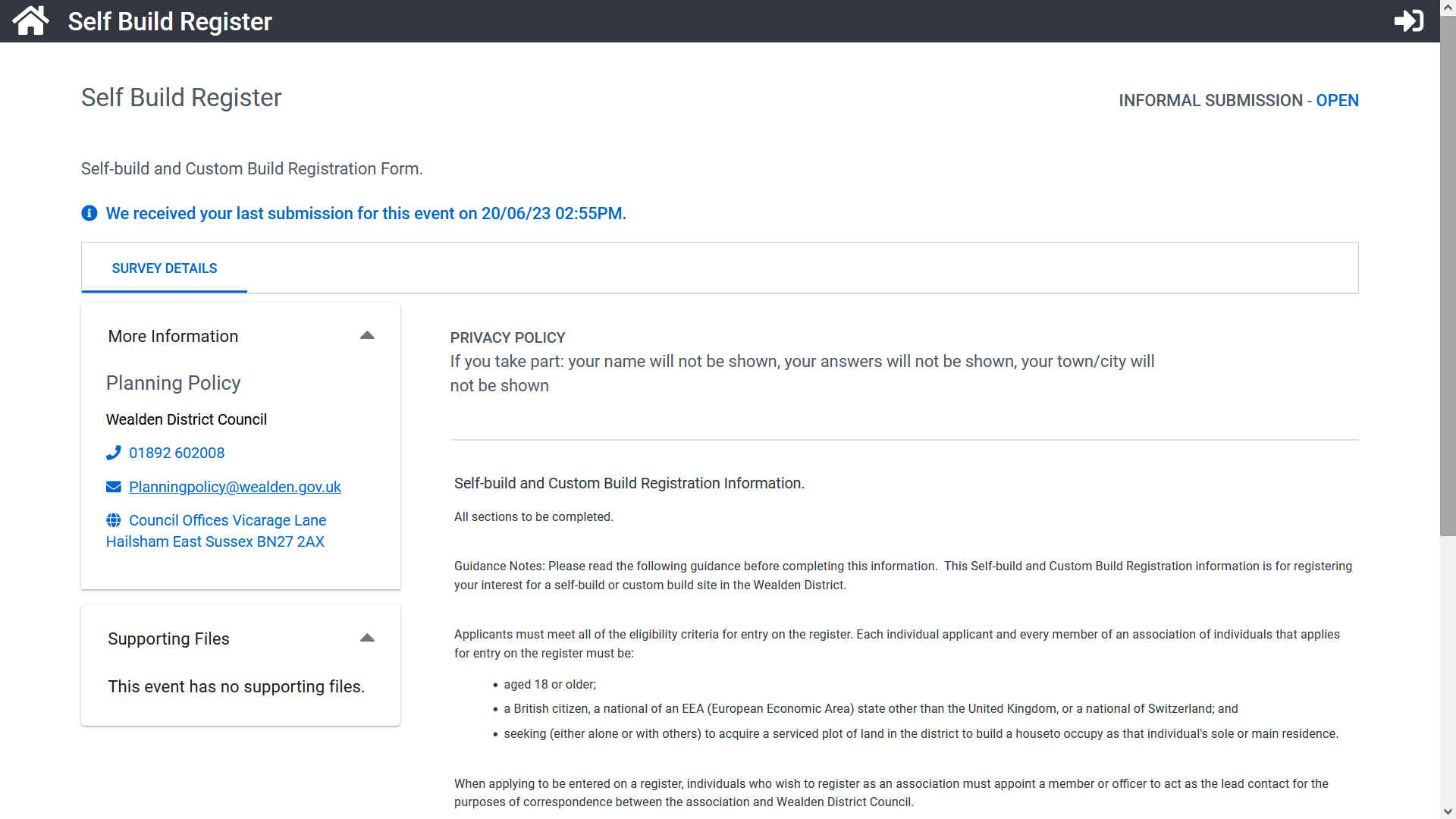

DON'T TAKE OUR WORD FOR IT - Why not apply yourself, and you'll see that there is no genuine effort to secure land for applicants. It is a compliance only scheme. In other words: Bullshit!

Since there is no affordable housing, and no plots of land for self builds. Wealden (as just one example) are (must be) in Breach of Contract. All contracts need to be reasonable. One cannot charge for a service, and not provide it. It is basic law. That is fraud!

Councils believe they are above the law. Hardly surprising, when they can buy/hire a court.

That scenario makes them judge and jury.

And, for example, if the terms of a contract are challenged, and the provider refuses to itemize expenditure. To prove that the taxes they are asking for are reasonable, then the case is likely to be decided for the citizen.

If the council's charges are not reasonable, there can be no liability. Moreover, the breach of contract, generates a counterclaim in any real Court. The counterclaim being against fraud, and/or failure to provides adequate services. See sections 3 and 4 of the Fraud Act 2006:

THE FRAUD ACT 2006

S.3 Fraud by failing to disclose information

(a) dishonestly fails to disclose to another person

information which he is under a legal duty to

disclose, and (a) occupies a position in which he is expected to

safeguard, or not to act against,

the financial interests of another

person,

(2) A person may be regarded as having abused his position even though his conduct consisted of an omission rather than an act.

If a council fails to provide a service, especially one that reduces the council tax they are asking for, there can be no liability. For they are in Breach of Contract.

If they fail to provide detailed accounting information relating to the efforts (or lack of) to procure land for self-builds, according to S. 3(a) of the Fraud Act, they commit an offence. And, they are in breach of contract. Being contractually obliged to provide lower banded homes. Hence, they fall foul of S. 4(1)(a) and S.4(2), in that they abused their position of trust, by way of an act of omission.

The refusal to provide information, also being an admission that they are fraudsters. In addition, another Breach of Trust, and their Duty of Care, and Duty to be Reasonable. (The Wednesbury Rule) There is also a Duty to Provide an Effective Administration. Upheld by the High Court.

We ask how it can be that a local authority that fails to provide:

a) affordable housing, b) identify land for affordable housing, c) provide land for affordable housing for self builds

Can be held to be effective?

THE EUROPEAN COURT OF HUMAN RIGHTS

Where there is no Legal Aid in the UK to be able to challenge Councils, The first port of call would be to the European Court of Human Rights (ECHR). What is needed is a case that has ruined a family, violating Article 8, the right to a private and family life free of interference from local authorities.

Perhaps if council taxes (and no affordable housing in the vicinity) have been part of the cause of eviction or bankruptcy. You'd need to be able to show the ECHR that there are no affordable lets, or plots for sale in your area. That is easy, look online for the cheapest rentals. The internet quite cheaply provides evidence of how high renting costs are. Then, put you name down for a plot as a self build. And don't worry that you don't have the skills to assemble a flat pack - should that ever come to pass. The sellers provide teams of installers for you.

Then, phone around or visit about 10 solicitors, making sure to secretly record the conversations as evidence. You will find that nobody will take such a case. They will tell you that Legal Aid is not available for such challenges. Or tell you they don't deal with such cases and point you to the another non-starter, or the Law Society. The Law Society will give you a list of so-called solicitors who take on Legal Aid cases, many of which you will have already contacted - and said NO!

Armed with this information, your Notice of Eviction, Council Tax demand, or, Liability Order - that caused the hardship, you will (or should) have sufficient cause to make a Claim in the European Court.

But before that, we'd suggest bringing to the attention of the Justice Minister (Lord Chancellor) for comment, (Alex Chalk as we write) and perhaps, the Head of State. Who, at this point of time is King Charles III, c/o Buckingham Palace. As we understand it. This is because you need to exhaust all local remedies, and you have a right of audience with the King or Queen, as per the 1689 Bill of Rights. If you are ever granted such audience, take a McKenzie friend along. But, don't hold your breath. We've never heard of the former Queen, or present King ever granting such an audience. So, put a reasonable time limit on reply. When that expires, you might reasonably proceed to Europe, or The Hague.

A recent enquiry of the ECHR elicited this response:

An application to the ECHR must be sent in writing to the following

address, beforehand taking careful note of their admissibility criteria:

If Europe cries off, then you should have access to The Hague. The Hague or Den Haag is the capital of the province of South Holland. The city is located in the Randstad. With 500,000 inhabitants, it is the largest city in the Netherlands after Amsterdam and Rotterdam. This is the location of the UN's International Criminal Court of Justice. Your grounds are Mental Torture (Article 5), and large scale fraud. In the UK, you have no effective remedy Article 8. These article numbers are different in the European Court, where Article 3 is Mental Torture and Article 13 is the right to an effective remedy.

There is no Article 13 in the UK's Human Rights Act 1998. They deliberately left that out, along with Article 1. Why? Because "Great Britain" had no intention of giving you that right. Sanctioned, by the Lords Spiritual and Temporal. The Church of England, was of course manufactured by Henry VIII, to allow him to bed more wives. After the Catholic Church refused to apply their seal of approval on his bedroom shenanigans. So, King Henry, invented his own religion. Which, potentially means, that all laws passed in the UK in the last 100 or so years, are based upon a whim of a former king's indignation at being called out by an independently established faith. Long live the Royal phallus, and all the laws in the wake of it's rise and fall.

Brings to mind the superb comedy film, 'Coming to America,' with Eddie Murphy as the Prince of Zamunda; the bathing scene.

THE

UNIVERSAL DECLARATION OF HUMAN RIGHTS Article

3. - Everyone

has the right to life, liberty and security

of person.

HABITUAL PROFESSIONAL LIARS

And Wealden's officers have been caught out lying umpteen times. They simply cannot be trusted to tell the truth. In fact, it is alleged that their officers are paid to lie. As Ian Kay once admitted, after the infamous Bushy Wood demolition appeal. A public inquiry held in Hailsham (we believe).

And Doug Moss also admitted, having kept copyright photographs that he said (in writing) he'd returned, then gave them to David Phillips, who used then in the High Court claiming a different date attribute. Not only fraud, but perversion and an attempt to pervert the course of justice - and perjury. Perjury is a legal term that refers to an offence where the perpetrator plans with others to tell lies in a court of law, under oath. The offence of perjury is covered by the Perjury Act of 1911. In this case, Phillips refused to go back into the Court, knowing he and his co-conspirator J D Moss, could be committed. The evidence was so strong.

Ian Kay perjured himself during a public inquiry over Stream Farm at Horam, when he told an Inspector he had no idea where an aerial photograph had come from. Yet the secret file in Wealden's offices showed the same photograph (pre-inquiry) with the note on it: "Return to IMK." Ian Kay (assistant district planning officer) also denied Wealden spent money on aerial photographs, and yet the Strategic Planning & Economic Development Committee (S.P.E.D.) had authorised such expenditure, precisely against planning and CLEUD (Certificate of Lawful Existing Use or Development) matters. Kay's evidence was given on oath. The photograph he lied about proved the area claimed by the applicant, had been used for over 10 years. Thus, the applicant was entitled to his Lawful Development Certificate. Ian Kay already knew that, hoping the applicant had not done his homework. He had, and he got his Certificate after a grueling Public Inquiry. The Inspector had no choice in the matter. The date on the photograph proved 10 years of use. Another case of Fraud, reported to Sussex police, and not acted on, as one of a number in a Petition. Not only fraud, but also perjury.

Please note that Wealden routinely destroy inconvenient and incriminating documents to cover their tracks, even though that is illegal. We have several proofs as to that. We also have proofs as to Sussex police stealing privileged papers to order.

Both officers should have been jailed, not furnished with enhanced pensions, at public expense. But Sussex police refused to investigate, despite a Petition. Rather the opposite, actually providing their headed paper to Wealden, for their officers to write that they wanted the police to say. Wow! Yes, that is true. Thus, we have a conspiracy to pervert the course of justice. A cover up, against which there is no statute of limitations, and the investigation is ongoing. We need zero tolerance to liars and cheats in positions of trust: Civil Servants. They cost the nation a lot of money. One of the reasons, as The Sun newspaper has pointed out, why out National Debt is so high.

It is alleged that Wealden District Council is rife with professional liars. Officers and staff not blowing the whistle, to safeguard their juicy pensions. When the duty is to spill the beans. Perhaps Mr Sunack, and Keir Starmer, if he gets elected, might want to start by sacking council officers who have lied. And, claw back unlawfully obtained pensions, etc., as proceeds of crime. Please get in touch for details. Help us to help you get the British economy back on track.

In Wealden alone, it is estimated that around 10% of the staff will have knowledge of the wrongdoing of other members of staff. Multiply that by the number of councils in England, Wales and Northern Ireland, and you will have the 90,000 job savings Rishi Sunack is being asked to make. Then take a look at the civil servants in Whitehall. Who knew about Boris Johnson's lies? Find them and sack them. It is in the public interest to pursue dishonest civil servants, and reclaim their ill gotten gains. You cannot leave it to local police, they are in on it. You'd need a special Flying Squad, dedicated to unraveling white collar fraud and cover ups.

While

you are at it, why not purge the police. Sack all officers involved in

covering up planning crime. Where, failing to investigate a crime, is a

crime in itself. A sack-able offence: R v Dytham [1979] Q.B. 722 is an English criminal law case dealing with liability for omissions. The court upheld the common law mantra that if there is a duty to act, then failure to do so is an offence

(willful neglect). The defendant was a police officer. He stood by whilst a bouncer kicked a man to death. He was charged with the offence of misconduct in a public office.

Dytham argued that the offence could not be committed by an omission as it specifically requires misconduct.

CRUSADERS FOR RIGHT - Dr King Schultz and Django Freeman (Christoph Waltz & Jamie Foxx) out to kill the Brittle brothers at Spencer "Big Daddy" Bennett's Tennessee plantation. Bennett pursues them with an armed posse, when Schultz ambushes the posse with explosives and Django kills Bennett. Feeling responsible for Django, Schultz agrees to help him find and rescue his wife Broomhilda, and Schultz trains Django to become a bounty hunter. Jango and Broomhilda were separated after trying to escape, and being caught.

The avenging

bounty hunters find out that Calvin J. Candie has Broomhilda, and set out to purchase her. But Candie demands $12 thousand dollars for

her when he finds out the identity of Broomhilda. Candie demands Schutz

shakes hands to conclude the deal.

What a shame it is not so simple in a corrupt England, where slavery stills persists in the forms of unfair taxes, land control and high energy and food costs. We need more men like Django and Schultz for sure. Men of principle in Parliament, where such animals are as rare as rocking horse droppings.

But very occasionally, an issue like abolishing slavery finds support in high places. The what if scenario, so brilliantly painted by Quentin Tarantino, may happen in the United Kingdom, when the workers rise up to throw off the financial chains of their captors. Supported by a new breed of politician, who is looking for sustainable practices, in a truly circular economy. For that, we must cut out the deadwood, and start building low cost homes that are carbon neutral. A starting point for fair council taxes. No more executive houses for landlords to profit by, and so enslave the working population. Not until, there is an ample and sufficient supply of homes in Band A. And, not until councils are forced to divulge details of where your taxes are being spent.

We

have to make it that people can afford to live, without getting into

debt to pay slave traders, like councils and bankers.

Council officers who pursue such Orders, might be equated to plantation taskmasters, who whipped and beat the slaves in the colonies. What is the difference? See Django Unchained. An excellent movie by Quentin Tarantino. Where human lives were so cheap, they allowed dogs to rip runaways to pieces, and Africans to fight to the death. Of course the Romans did that, feeding the Christians to the Lions. So, it is nothing new, but just as barbaric. As is financial enslavement.

SLAVE

TRADING CONFLICT OF INTEREST - William Ewart Gladstone served as Prime Minister four separate times between 1868 and 1894 – more than any other

prime

minister. His family made its vast wealth through the sugar trade, with his father, John Gladstone, owning many slaves and several plantations in the West Indies. John Gladstone and William’s brothers made compensation claims following the 1833 Slavery Abolition Act and John received the largest payout of more than £100,000, which is £12 million in today’s money. Although William Gladstone did not own slaves personally, he benefited hugely from his family’s wealth. It supported his parliamentary career, and he inherited a fortune when his father died.

He would have done well in Wealden, as a councillor, or an officer.

PARLIAMENT AND THE SLAVE TRADE

THE ABOLITION MOVEMENT

ABOLITIONIST

- In 1807 Prime Minister Lord Grenville, introduced the Slave Trade Abolition Bill. Although it was met with resistance from the Duke of Clarence (the future king William IV) and other peers with West Indian interests, the House of Commons voted in favour of the bill by 283 votes to 16 – a victory that passed all expectations.

BANKING & BANKERS

ROYAL

BANK OF SCOTLAND

OFF THE SHELF FLATPACK HOMES PRICE EXAMPLE

https://www.quick-garden.co.uk/log-cabin-house-holland-plus-13-5mx8-5m-44x28-ft-66-mm.html

£42,499.00 Winter Super Deal. Price After 1 February

2022 £63,467.00 You save: £20,968.00

£42,171.00 – on offer (@ January 2022).

Firms like Ikea are now investing heavily in factory built designs, so reducing the cost of housing.

PUSHING COUNCILS TO DO THE RIGHT THING

Council's are notoriously slow at producing local plans, and when they do they fail to identify land as a rolling stock that is earmarked for affordable housing - despite the fact that this is their statutory function. This is because of drug money and other immoral earnings, such as oil money, without any checks as to the legitimacy of the sums, as to taxes paid in the country of origin. And how the investors earned their money. The UK is the most corrupt country in the world in this regard. With the city of London being the international laundering capital of the world.

At the moment, we suspect that CIL taxes are being invested in fossil fuels for officer pensions - or something such like. Whereas, these local taxes should be spent on the community.

Will anything change with Labour, or Liberal Democrat councils, over Conservative slavery policies?

Map of the Wealden District

LINKS

https://www.msn.com/en-gb/money/other/rishi-sunak-told-to-axe-90-000-jobs-to-save-uk-from-economic-disaster/ar-AA1gmWcG

FARMING - The backbone of any society is the production of food to feed the population, though these days much of what we eat is imported from other producers, such as fish farmed in Asia. We can no longer find enough fish locally having exhausted our fisheries. Agriculture is also changing where we have drained the soil for so long with artificial fertilizers that yields will fall, meaning a shift to obtaining protein from the sea - but unfortunately we are disposing of around 8 millions tons of plastic in our seas - poisoning marine life that we need to keep us nourished. Food security is therefore high on the United Nations and EU agendas via the Food and Agriculture Organization.

|

|||

|

|