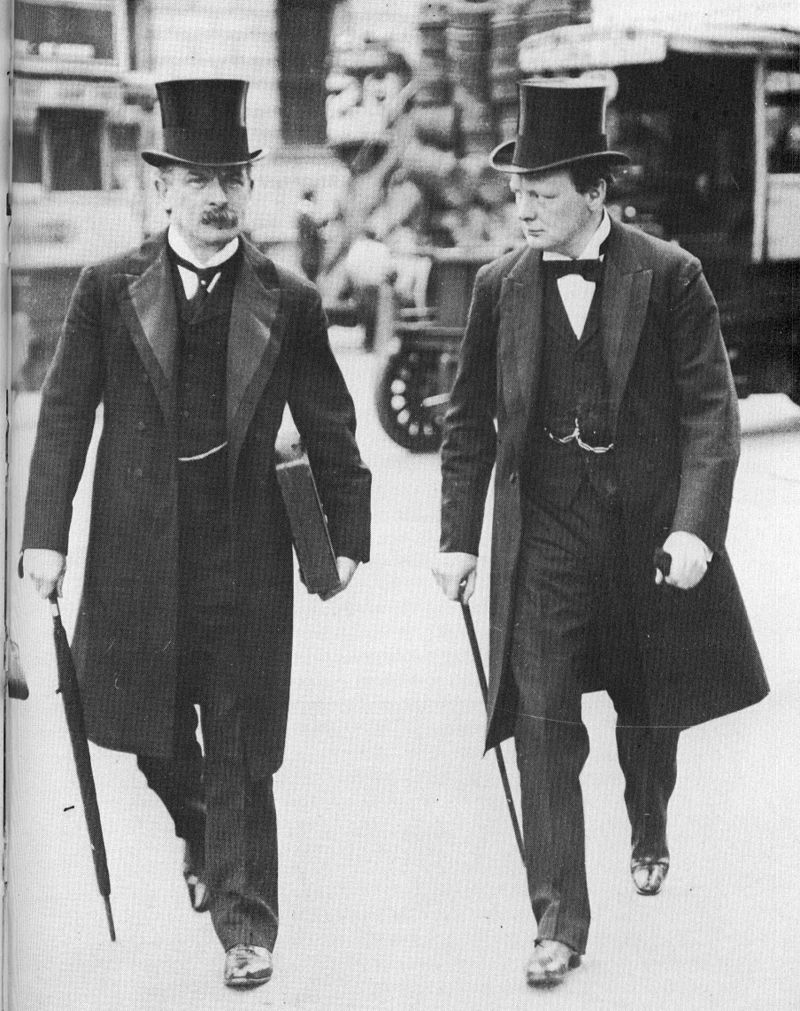

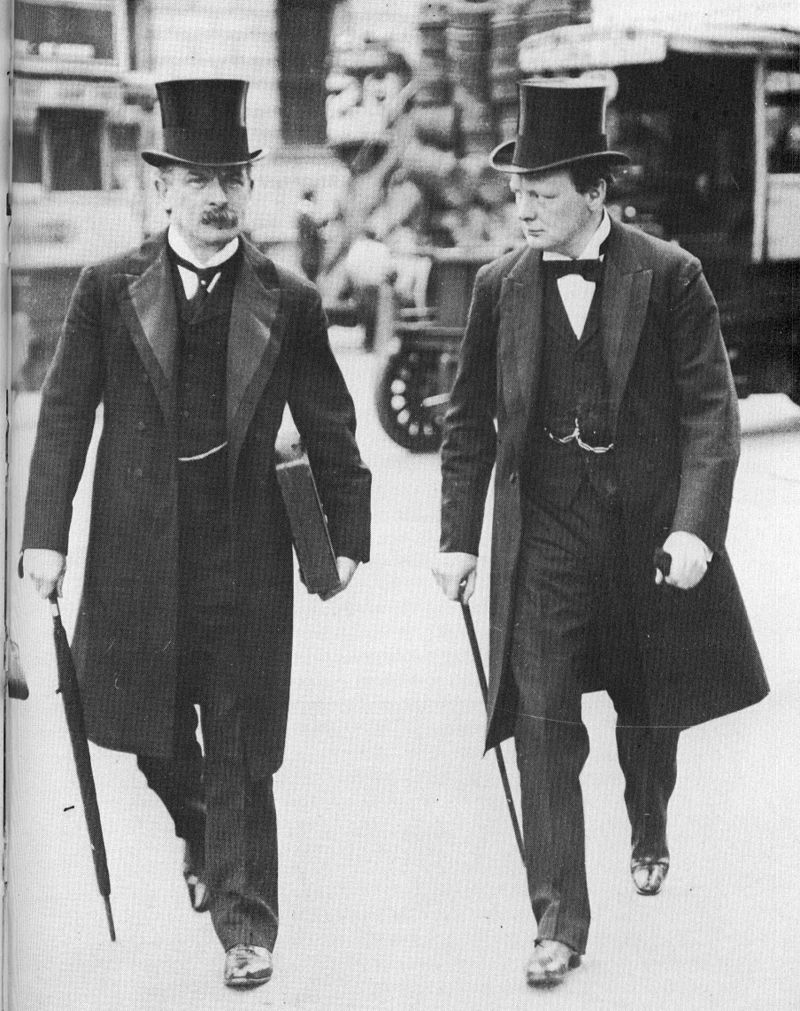

Two

of the greatest social reformers in British politics, Lloyd

George and Winston

Churchill. The Trade Descriptions Act 1968 came into effect on 30 November 1968. It replaced and expanded the old Merchandise Marks laws dealing with mis-description of goods in general and its particular job is to ensure, as far as possible, that people tell the truth about goods, prices and services.

We think this should apply to politics and politicians.

In

order to create wealth, an entrepreneur has to find a way to

make a profit from goods or services. Brilliant. Everyone should

be able to profit from the efforts of their labours.

But,

and this is a big but. When an entrepreneur discovers a way to

make huge sums of cash, without giving anything back to society,

such as to balance the books in terms of financial slavery and climate

change, then, a state should step in and demand societal

interest by way of statutory adjustment. Such taxes to go to the

people who have been exploited, and to repair the high carbon

footprint generated from profiteering, to offset climate

change.

These

taxes cannot go into a corrupt system, such as to allow the

likes of Boris

Johnson, to squander them, and scatter amongst his Conservative

Peers, by way of Government contracts for backhanders, which is

of course Procurement Fraud.

We

would defer to an honest politician like Honest

John, who is unfortunately a fictional character, but with a

rather interesting Manifesto.

UNFORTUNATELY,

NOT A JOKE - Held to be the Anti-Christ

of British politics, candidates like Boris Johnson and Margaret

Thatcher, would no longer be able to treat the electorate

like disposable assets, as in British

Empire days - to keep their wealthy party supporters in the

lap of luxury. So, sustaining a class system and slavery. The

Big Red Bus 'lie' changed British statute (fictionally), to

prevent the lesser informed electorate from being deceived, and

so, in effect, voting to increase national debt and ultimately

hardship. Election campaign rules were continuously monitored

and enforced to ensure truthfulness from candidates.

THE GUARDIAN 19 DECEMBER 2022 - Call for wealth tax as UK billionaire numbers up by 20% since pandemic

The number of UK billionaires has increased by a fifth since the onset of the Covid pandemic, according to a report calling for a progressive wealth tax to tackle rising inequality amid the cost of living crisis.

The Equality Trust charity said interventions by governments and central banks during the pandemic allowed for an “explosion of billionaire wealth” in Britain at the expense of the rest of society, after fuelling a boom in property values and on the stock market.

At the onset of the global health emergency three years ago, the Bank of England and other big central banks around the world crashed interest rates to zero and pumped billions of pounds into financial markets through their quantitative easing bond-buying programmes. Aimed at softening the edges of the worst recession in three centuries by supporting businesses, households and governments with lower borrowing costs, the report found the policies also helped inflate asset prices, helping to line the pockets of wealthy investors.

The Equality Trust said this had contributed to the number of UK billionaires increasing from 147 in 2020 to 177 this year, with the median billionaire now holding about £2bn.

“This sudden explosion in extreme wealth was in large part due to measures aimed at lessening the impact of Covid-19 on the economy, as central banks pumped trillions of dollars into financial markets, leading to a stock market boom which effectively lined the pockets of shareholders,” Jo Wittams, co-executive director of the Equality Trust, said in a report published on Monday.

“While Covid-19 saw billionaire wealth rise to levels never seen before, the construction of the economic infrastructure that has enabled this mass accumulation stretches back over the last four decades.”

The report found that the number of billionaires in the UK had risen more than tenfold from 15 in 1990, when the Sunday Times first published its Rich List, after taking into account inflation over that time period.

Using inflation-adjusted wealth data from archive copies of the Rich List, it said the combined wealth of Britain’s billionaires had risen from £53.9bn in 1990 to more than £653bn in 2022. “This represents an increase in billionaire wealth of over 1,000% over the past 32 years,” the report said.

“That we have allowed the very richest few to accrue such a staggering amount of the nation’s wealth since 1990 is a national disgrace,” Wittams said. “The UK’s record on wealth inequality is appalling, grossly unjust, and presents a real threat to our economy and to our society.

“Every year we are invited to celebrate the very richest individuals and families in the UK, while food bank usage continues to increase, 3.9 million children are living in poverty and 6.7m households struggle to heat their homes. That these are two sides of the same coin is very rarely mentioned.”

Wittams said inequality did not have to be inevitable. “The right policies can have a positive impact,” she said. “We call on the government to tax wealth in line with incomes, reform the financial sector and end the UK’s role in tax avoidance. Two-thirds of the British public agree that ordinary working people do not get their fair share of the nation’s wealth and it is time the government took action.”

Tax equality campaigners claim the government could raise up to £37bn to help pay for public services if it introduced a string of wealth taxes.

Tax Justice UK has called on the government to introduce five tax reforms targeting the very wealthy, who the campaign group said had done “really well financially” during the

coronavirus crisis and national lockdowns, rather than seek to save money with further cuts to public services.

“Tax is about political choices. At a time when most people are being hit hard by the cost of living crisis it would be wrong to cut public services further,” said Tom Peters, Tax Justice UK’s head of advocacy. “The wealthy have done really well financially in the last few years. The chancellor should protect public spending by taxing wealth properly.”

The campaign group, which is calling for a “fairer tax system that actively redistributes wealth to tackle inequality”, suggests five wealth tax reforms.

The measures include equalising capital gains tax with income tax, scrapping the non-dom regime and introducing a 1% tax on super-rich people’s assets over £10m – which, they claim, could

raise £10bn on its own.

THE GUARDIAN 30 NOVEMBER 2022 - HEDGE FUND BILLIONAIRE SIR CHRIS HOHN PAID HIMSELF £1.5M A DAY THIS YEAR

The £574m payout is thought to be highest annual amount ever paid to one person in Britain.

The billionaire hedge fund manager Sir Chris Hohn paid himself a record-breaking $690m (£574m) this year after his Children’s Investment (TCI) fund recorded a a surge in profits.

The payout from the Mayfair-based hedge fund, where the prime minister, Rishi Sunak, worked between 2006 and 2009, is the biggest ever collected by Hohn and believed to be the highest annual amount ever paid to one person in Britain. It equates to more than £1.5m a day.

The dividend payment from TCI Fund Management is 15,000 times the average UK salary, and is about 3,500 times that collected by Sunak as PM. Accounts filed at Companies House on Tuesday show the money was paid to another company controlled by Hohn. It is understood that Hohn reinvested the windfall in TCI.

The sum for the year to the end of February is up from $152m the previous year, and up from a previous record of $479m the year before that. A spokesperson for the company did not respond to requests for comment.

The High Pay Centre’s Luke Hildyard, who campaigns against excessive executive pay, called for higher taxes on top earners such as Hohn. “Hedge fund profits come from the corporations they invest in and the fees charged to their super-rich clients,” he said.

“It would be easy for policymakers to get corporations and the super-rich to pay their staff more and pay a bit more tax, meaning much of this £575m would be going to support the incomes of ordinary workers or fund vital public services instead.”

Hohn, the son of a Jamaican car mechanic who emigrated to Britain in the 1960s, set up TCI in 2003 and has built up a personal fortune of more than $8.2bn, according to the Bloomberg billionaires index.

Hohn and TCI are known for running aggressive campaigns for change at companies they invest in. Earlier this month he called on Google’s owner Alphabet to take “aggressive action” on costs. “The company has too many employees and the cost per employee is too high,” he said in a public letter.

The fund is famous for its campaign against Dutch bank ABN Amro, which led to its sale to Royal Bank of Scotland, seen as a key reason for RBS’s near collapse during the financial crisis.

The hedge fund, which is based in a Mayfair townhouse a couple of doors down from Louis Vuitton’s flagship store, is ultimately owned by a parent company in the Cayman Islands, a tax haven.

Hohn is also one of the UK’s biggest philanthropists, and has pumped more than £4bn into his personal children’s charity. In recent years he has also taken on the cause of the climate crisis, promising to use his fund’s $35bn of investments to “force change on companies who refuse to take their environmental emissions seriously”.

He is the biggest single donor to Extinction Rebellion on account of the “urgent need” for people to wake up to the climate emergency. “I recently gave them £50,000 because humanity is aggressively destroying the world with climate change and there is an urgent need for us all to wake up to this fact,” Hohn said in 2019. His charity is thought to have pledged a further £150,000.

Hohn, who has only given a handful of tightly controlled media interviews throughout his career, pleaded with the high court judge overseeing his 2014 divorce from Jamie Cooper-Hohn to ban the media from the courtroom.

However, the request was denied, giving the public a glimpse into the billionaire’s surprisingly modest lifestyle, his motivations for making so much money and why he didn’t view his wife of 17 years as worthy of half of the family fortune.

Although he was in a fight over a huge amount of money, Hohn said his life’s mission was to give money away. “My life is actually about charity,” he told the court. “I learned very early on you cannot take money with you. It does not bring you happiness.”

He said he lived a “very simple lifestyle”, avoids meat and practices yoga. On hearing the evidence, the judge noted that the couple lived a “Swatch lifestyle” not a “jet-set lifestyle”.

Hohn, who grew up in Addlestone, Surrey, said he first decided to give money to charity while working in the Philippines, where he had seen children living on a rubbish dump.

“I considered being a doctor and working in a caring profession,” Hohn, 54, told the court. “[But] a dream or aspiration without resources is just that.” He compared his ambition to become a philanthropist to other young people who set their hearts on being able to “play for Chelsea or be a top QC”.

THE

TOP TEN RICHEST - 2022

1.

ELON MUSK

2.

BERNARD ARNAULT

3.

GAUTAM ADANI

4.

JEFF BEZOS

5.

BILL GATES

6.

WARREN BUFFET

7.

LARRY ELLISON

8.

LARRY PAGE

9.

MUKESH AMBANI

10.

SERGEY BRIN

https://www.theguardian.com/business/2022/nov/30/sir-chris-hohn-paid-himself-equivalent-of-over-15m-per-day-this-year

https://www.theguardian.com/news/2022/dec/19/call-for-wealth-tax-as-uk-billionaire-numbers-up-by-20-since-pandemic

https://www.msn.com/en-gb/money/other/call-for-wealth-tax-as-uk-billionaire-numbers-up-by-20-since-pandemic/ar-AA15qJ3f

https://www.theguardian.com/business/2022/nov/30/sir-chris-hohn-paid-himself-equivalent-of-over-15m-per-day-this-year

https://www.theguardian.com/news/2022/dec/19/call-for-wealth-tax-as-uk-billionaire-numbers-up-by-20-since-pandemic

https://www.msn.com/en-gb/money/other/call-for-wealth-tax-as-uk-billionaire-numbers-up-by-20-since-pandemic/ar-AA15qJ3f

The

Holy Compass - is a (fictional) John Storm adventure